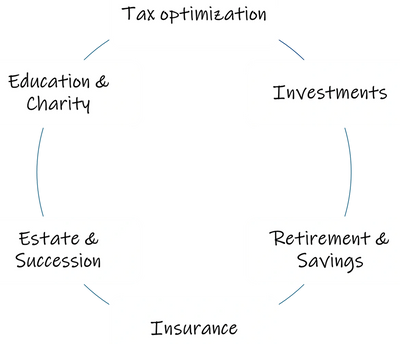

Our focus areas

Applying common views to both BUSINESS and PERSONAL financial planning

You are unique, and so is your business. You deserve a financial plan that addresses all facets of your life. We specialize in helping business owners to balance common and unique needs that arise from owning a business and securing a family. We provide investment and planning services that address business and family needs resulting in cohesive, comprehensive plans.

Running on personal trust

You are what matters to us. Our team of experts want to help you, your family, and your business make well-informed and wise financial decisions. We are here to help you strategize and put plans in place to grow, protect, utilize and ultimately transfer your financial assets.

The Categories of Financial Planning

Our Investment Philosophy

Evidence-based decision making in a disciplined fashion.

We design investment strategies to achieve client financial goals. We make evidence-based investment decisions fueled by data and rooted in diversification and tax-aware investments. We avoid highly unreliable ways to build wealth and risky practices like trying to time the market, anticipate trends or identify mispriced investments. Our portfolios are based on five pillars:

1 - Markets are EFFICIENT

2. Risk & Reward are RELATED

Eugene Fama hypothesized in 1965 that financial markets are efficient, so no one can gain an edge in them. Billions of dollars are now traded daily where buyers and sellers come together and agree on a price. Given so much competition, we believe current prices reflect both the latest news and the latest outlook for the underlying investment and the economy. Our approach presumes that an investment’s price is the best estimate of the current value, and we don’t try to outsmart the market. We don't believe anyone can do so consistently and in the long run.

2. Risk & Reward are RELATED

2. Risk & Reward are RELATED

This one is perhaps a little more self-evident. But if you want the potential for more returns, you’ll need to accept more risk and likely greater fluctuations in value. Sometimes these risks pay off with more return, but sometimes they result in losses. Although adding more unique sources of risk and return can create a portfolio with steadier growth, you shouldn’t take more risk than you’re comfortable with.

3. Diversification Is ESSENTIAL

Using a single stock, strategy or investment type is riskier than mixing lots of different types of investments. Holding multiple investments reduces the risk that any single investment will cause a drag on portfolio performance. Because it is impossible to predict which stocks will drive the realized premiums, not being fully diversified exposes investors to greater uncertainty.

4. Pursue Factors of RETURNS

5. Focus on what we can CONTROL

Research has further shown that allocating more of a portfolio to companies that share certain characteristics can increase potential for return. Although these investments typically bring more risk, evidence-based portfolios are built to most efficiently allocate across multiple sources of risk — even if it means performing differently than headline indexes.

5. Focus on what we can CONTROL

5. Focus on what we can CONTROL

5. Focus on what we can CONTROL

We don’t try to predict interest rates, anticipate the impact of government actions or outsmart other traders or advisors. Instead, we focus on the areas that can be controlled — such as setting a thoughtful investment strategy and following a disciplined review process.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.